Managing My Money

Week 6: Housing & the Household Balance Sheet - Part 1, Episode 11

Share Radio & Open University Business School

'An Englishman's home is his castle'.

Anon

Welcome

to Managing My Money presented by Glen Goodman and Annie Weston

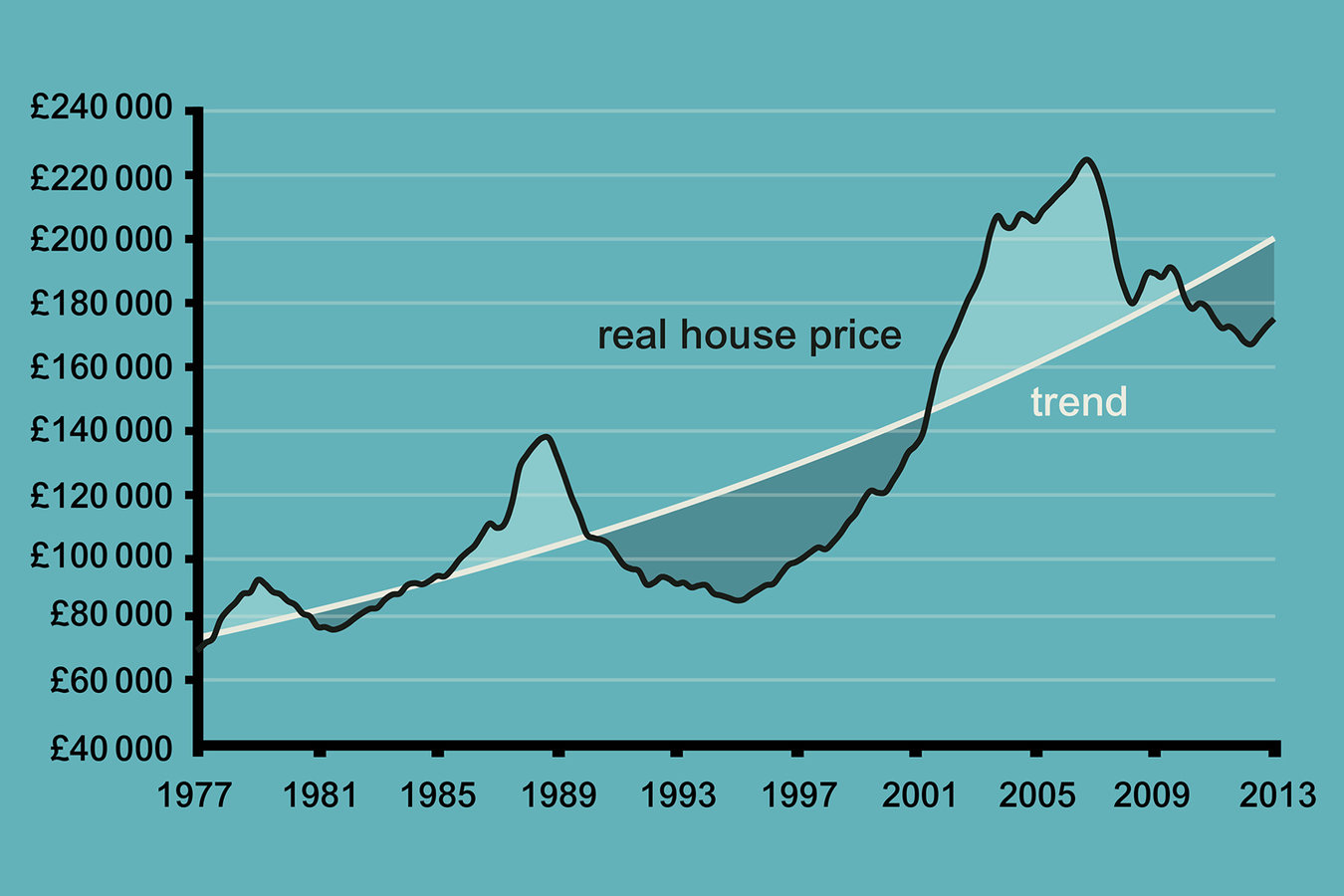

Getting on the Housing ladder

Where is affordable?

But renting is ..

- 'Paying someone else's mortgage'

- 'Dead money'

- 'Not helping with building retirement savings'

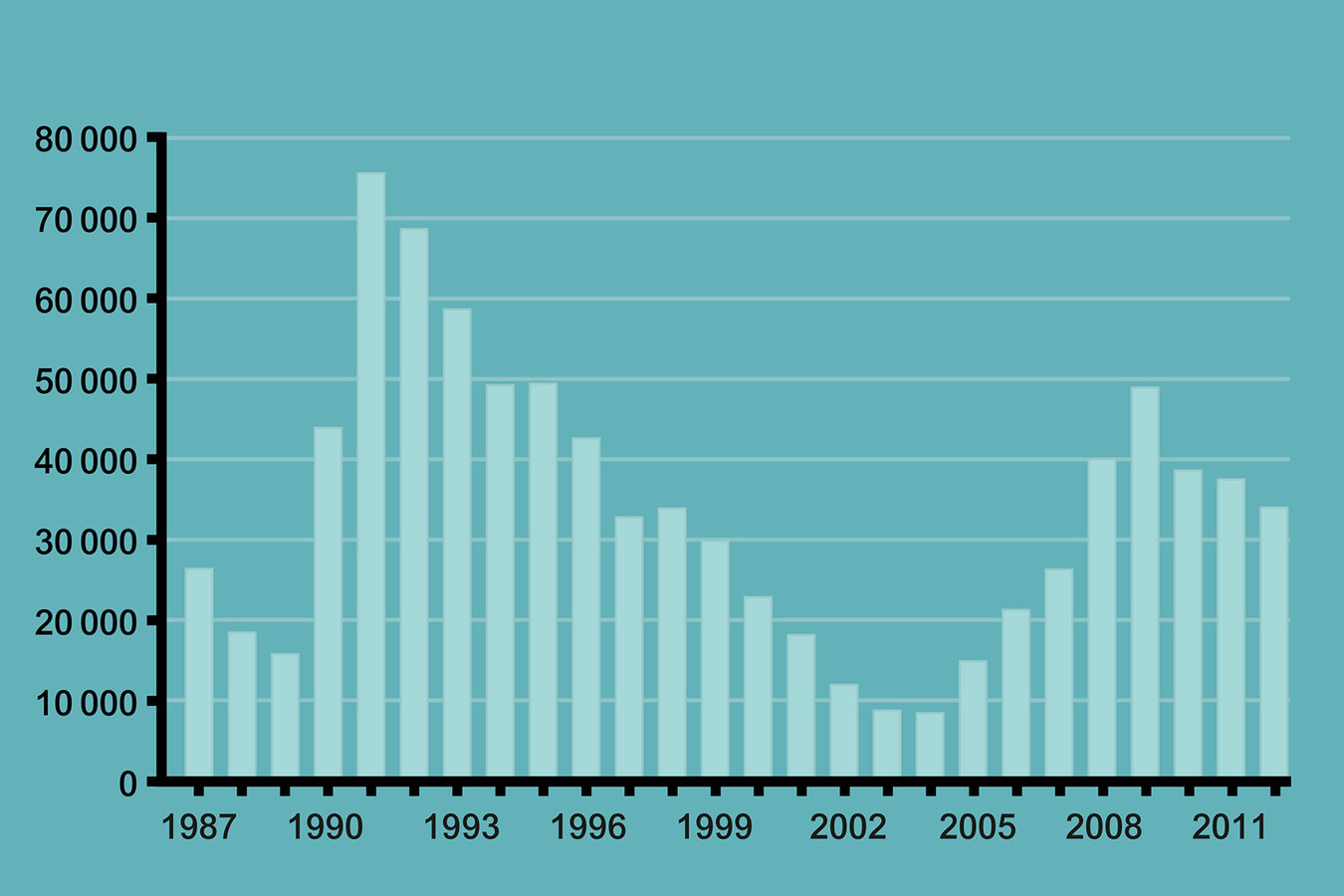

Mortgages taken into re-possession: a thankfully rare event

Mortgages - the basics

- A loan secured against your property

- A larger deposit can mean a lower interest rate

- 'Loan to Value' ratio helps measure your own 'equity'

- Different types of loan: fixed rate, variable, tracker ..

- Different methods of repayment

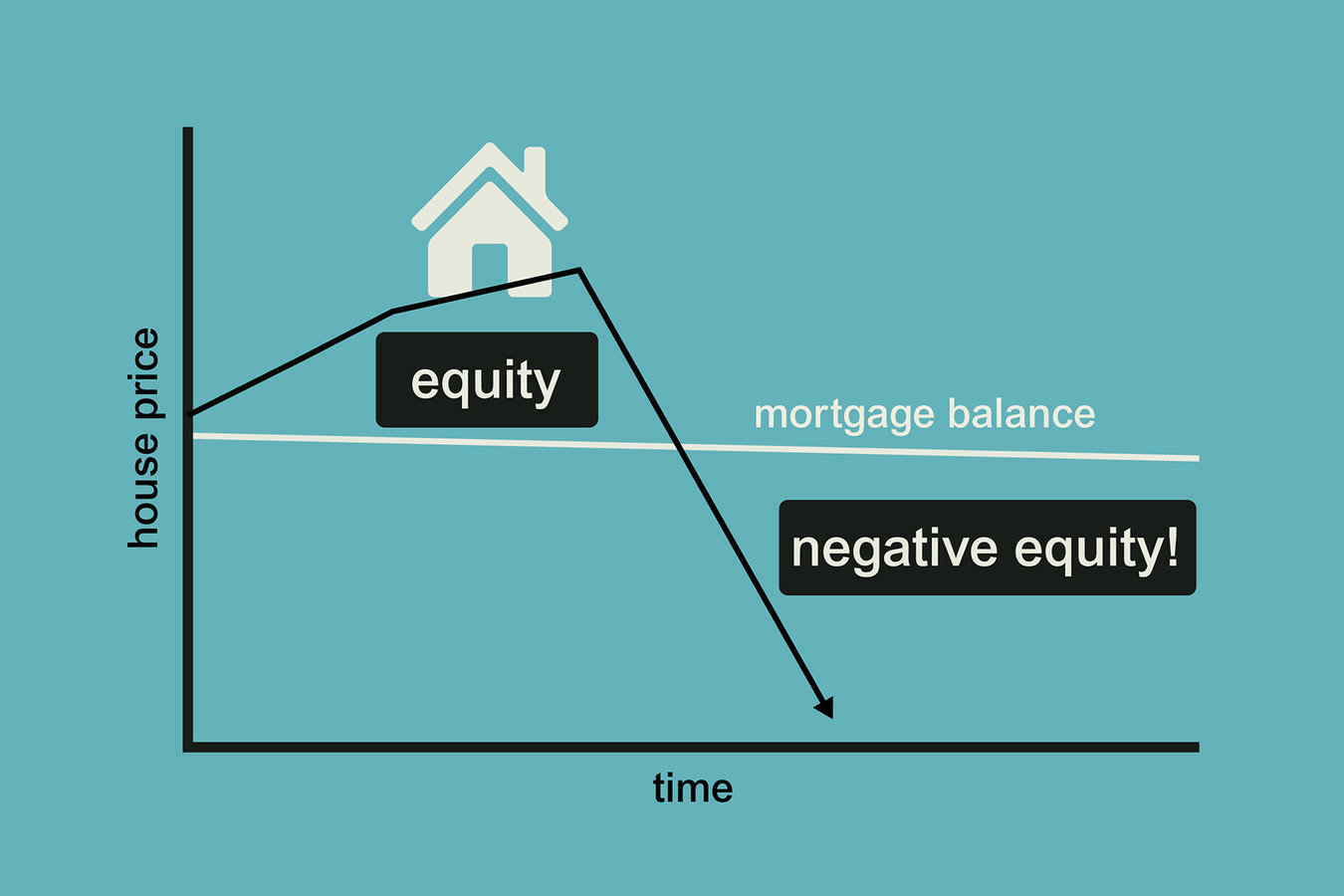

The perils of negative equity

.. of sitting and waiting until prices recover

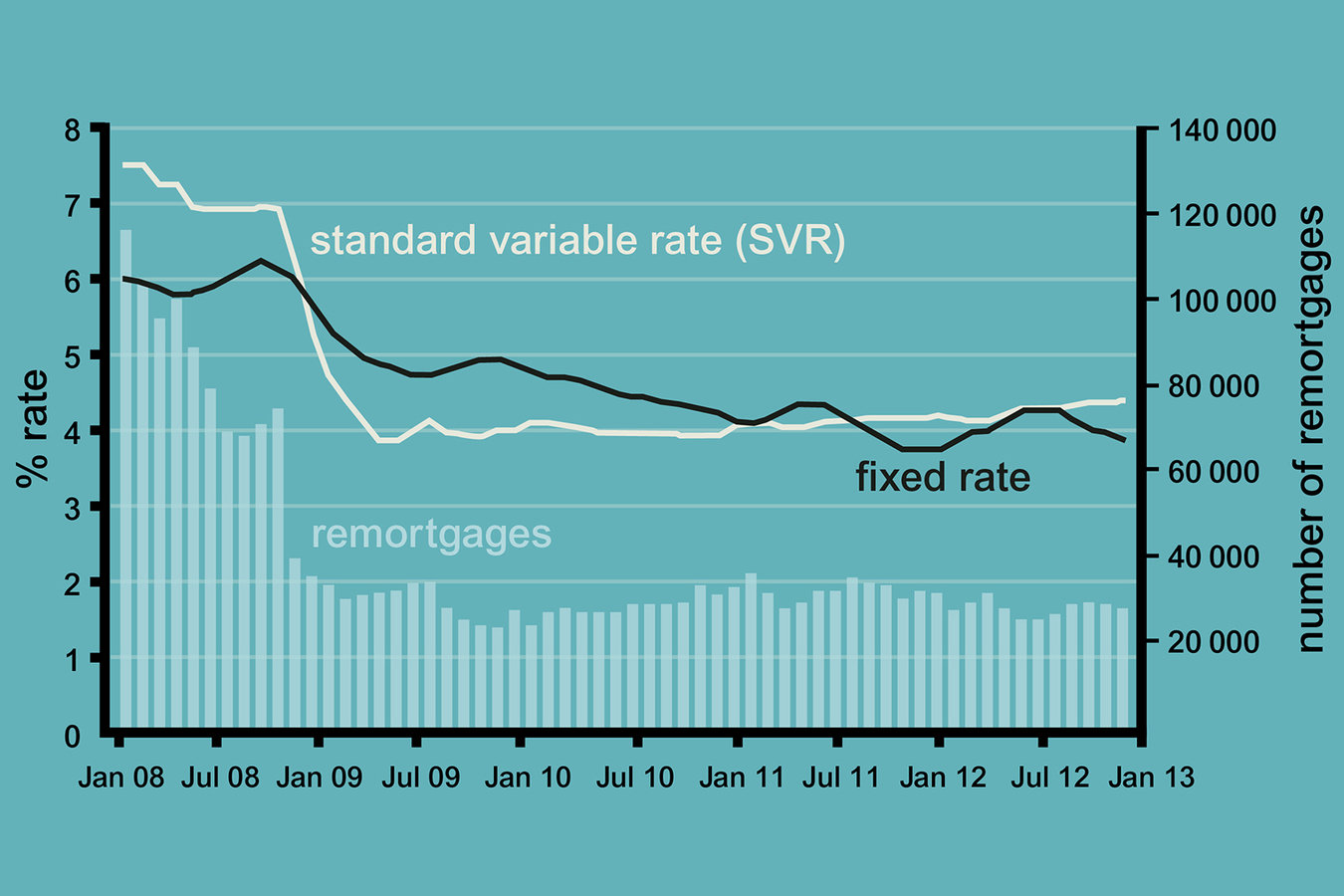

Different types of loan

- Fixed, variable, tracker rates

- Offset mortgages - can deduct deposit balance(s)

- Flexible - can vary your payments

- Shared ownership

- Repayment, Interest-only, Endowment

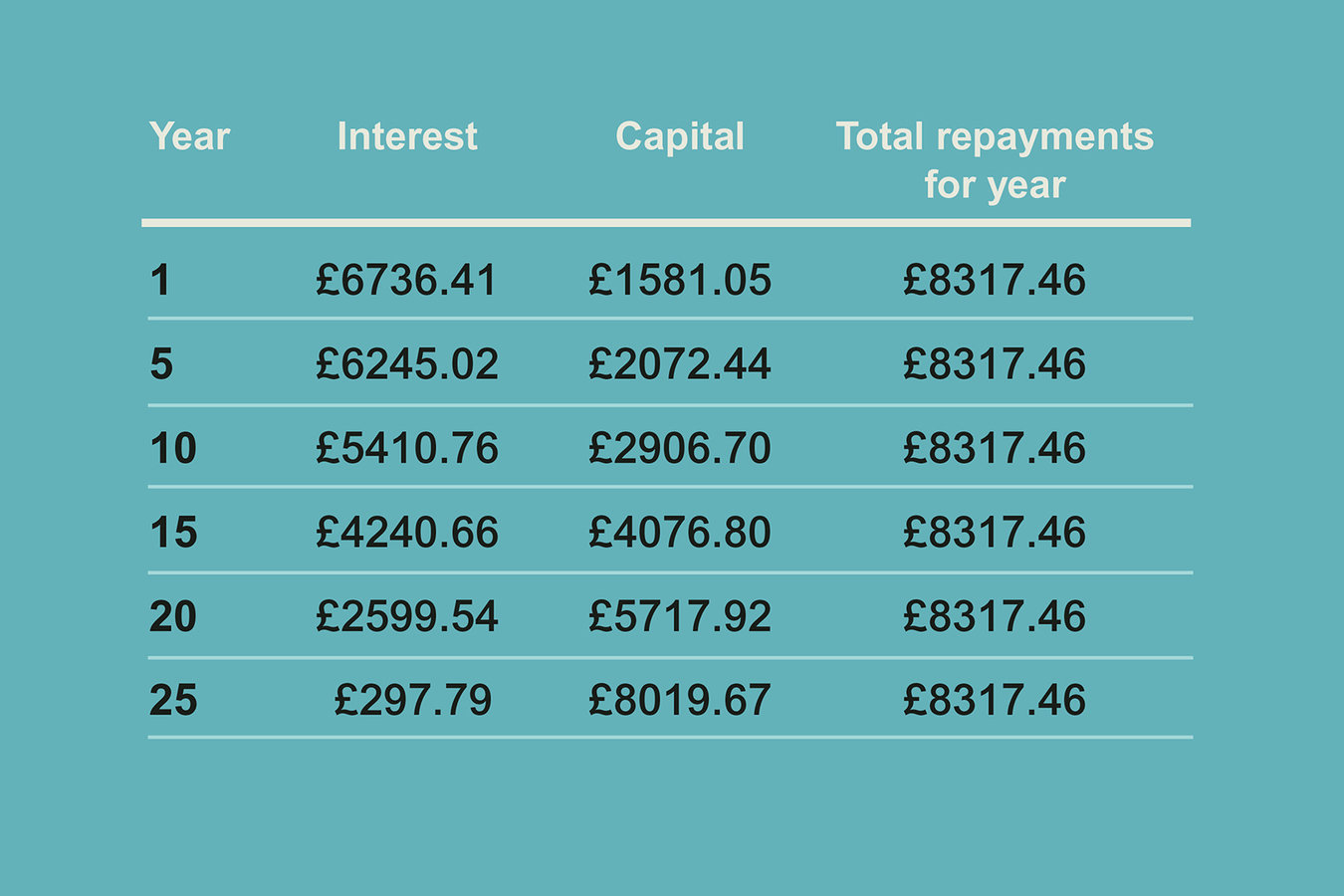

The pattern of interest and capital repayment changes over time although the total may remain constant

They're all waiting to take your money

Gazumping: the occupational hazard of house-buying

Happiness .. is a new home

Next:

Listen to Part 2 of Week 6 on Share Radio - then take the Week 6 quiz/test. As you take each week of the course, your results will build up on your personal dashboard.

Managing My Money

is broadcast by Share Radio and is based on the Open University Business School online course of the same name.

Your presenters are Glen Goodman and Annie Weston.